Are Google Hotel Ads the best way to grow your brand? Is this the answer to the ongoing issues with OTAs? This is a complex, multi-faceted question with an equally complex answer. However, for most vacation rental companies, the brief answer to both questions is no.

Why am I qualified to answer this question?

I launched my first AdWords campaign over fifteen years ago in 2003, covered this topic extensively for Search Engine Journal, grew my EdTech startup leveraging AdWords, and managed well over $30 million in annual spend across thousands of campaigns for an ecommerce conglomerate. Heck, in the day of nickel-clicks, I used Google AdWords to sell an airplane in 2004 – at a total campaign cost of $20!

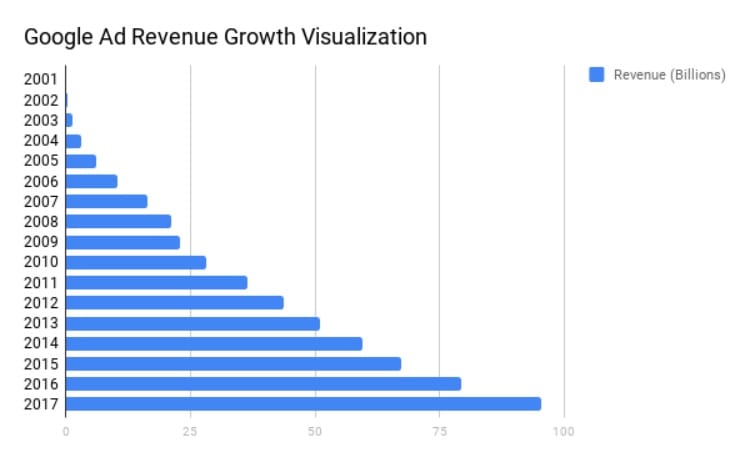

To better understand Google Hotel Ads, let’s take a walk down memory lane together. Here is a visualization of the increasing revenues that Google has experienced every single year.

Data Source: Statista

Those revenue and growth numbers are staggering for a company as mature as Google! We must understand that we are not dealing with a benevolent company that wants us to succeed. We are dealing with a company that charges a staggering $900+ for a simple intent-based click for its top keyword with zero guarantees on performance. In fact, $213.95 is the cheapest click you can find in the top 100 most expensive keywords! Remember those $0.05 clicks for money-terms? Those are now a distant memory…

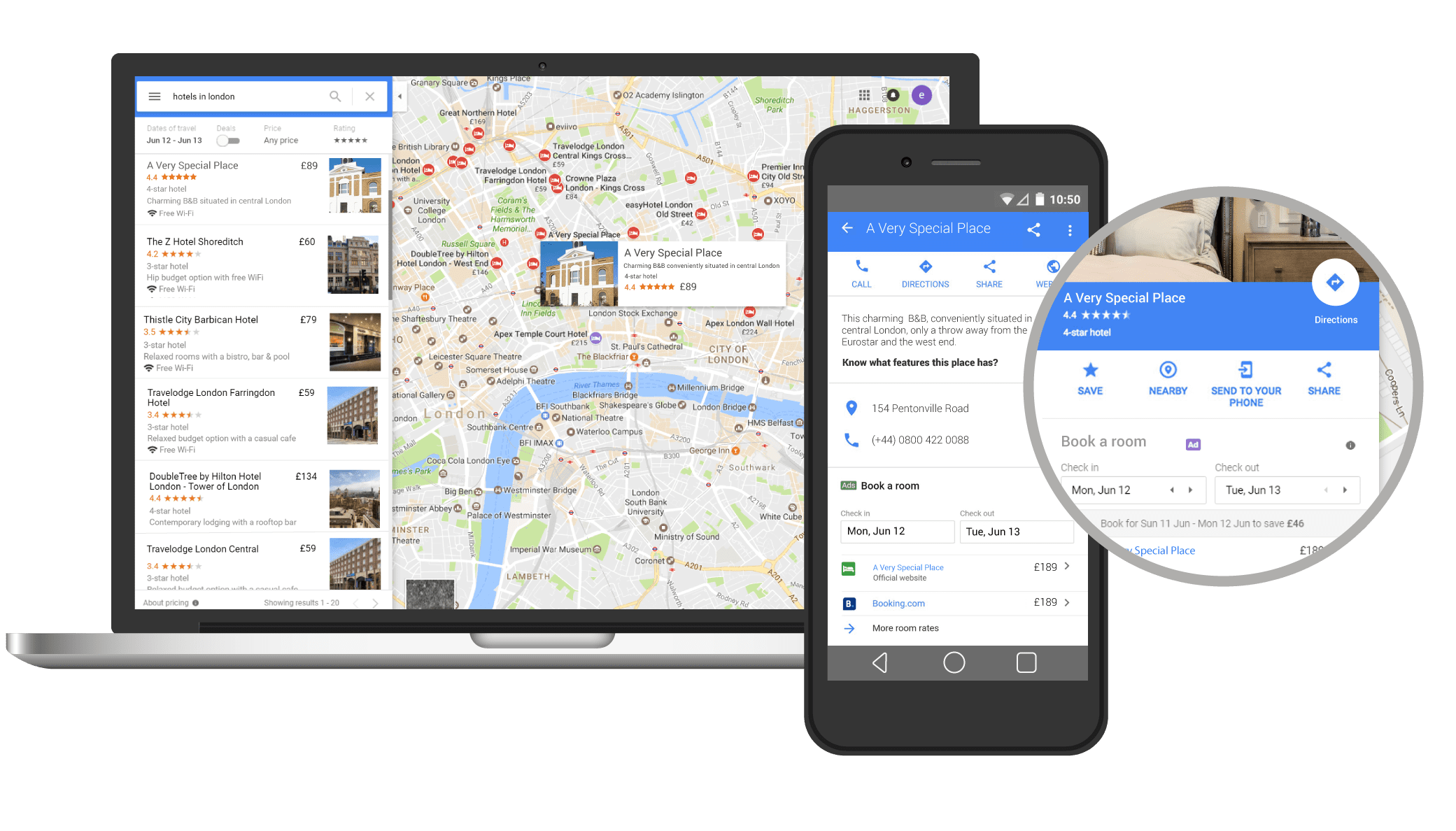

What is Google’s motivation for rolling out Google Hotel Ads for vacation rentals? Clearly, we are not dealing with an altruistic brand that is looking after our best interests. Ultimately, Google’s goal is to increase the ad spend for one of their revenue machines – Google Travel.

Exclusive Inventory Advantage?

Unfortunately, 99% of property management companies that have exclusive contracts will not have exclusive marketing rights. The company may hold exclusive contracts to manage the properties, but the exclusive marketing rights have likely been forfeited when the property manager listed on Booking.com, HomeAway, and Airbnb. In essence, this will drive down both the ROI and effectiveness of Google Hotel Ads.

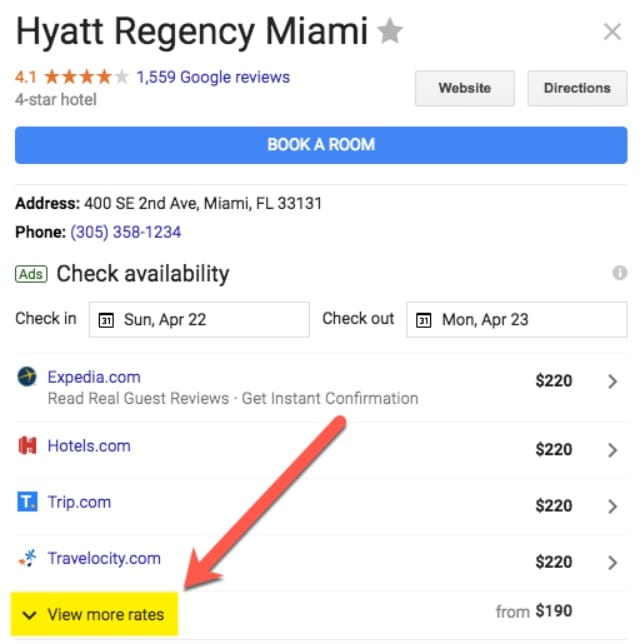

To see this in action, visit the hotel card for the Hyatt Regency in Miami and you may notice that the Official Site for the Hyatt Regency is nowhere to be found. The potential guest is only presented with OTA options!

How is this possible? The Hyatt Regency in Miami clearly has exclusive rights to the brand. However, once the exclusive marketing rights have been surrendered, consumers are then able to see all available options on the lodging card. The only way the consumer is even presented with the primary brand is by clicking the ‘View more rates’ option.

Even if your local brand overcomes the brand favoritism that Google typically defaults to, consumer confidence is inevitably higher with Booking or HomeAway as opposed to a local brand. Complicating matters further, additional fees (including the traveler fee) are not passed into the card rates, which creates the illusion of price parity until deep in the booking process!

The New OTA?

In an effort to increase the search engine’s profits from Google Hotel transactions, Google introduced the Google Hotels Ad Commission Program (GHACP) in 2015. This relatively new program analyzes your commission bid, brand’s projected conversion rate, and reservation’s rental value with fees excluded. Now, this information is converted to a bid that can compete with other commission bids and cost-per-click (CPC) bids in the ad auction.

Since the cost-per-acquisition (CPA) should be similar with both bid types, the majority of entrepreneurs that I have spoken to prefer the predictability and guaranteed returns of the commission-based bidding.

Depending on the competition in your rental market, a bid between 10% and 15% (rent line-item only) will be the norm. In addition to Google’s commision, you can expect an additional 2%+ in technology costs that will be charged by the authorized Google Hotels Integration Partner. The aggregate commission is similar to the typical 15% Booking.com commission or the 12% Airbnb program that eliminates guest fees.

However, it is worth noting that unlike a traditional OTA, the Google Hotels transaction will take place on your website and you will own the guest record.

Next Iteration of OTA Middlemen

Even large technology brands are having problems with their GHACP feed. While Booking.com was able to produce pre-populated dates and only display available units, HomeAway had issues with nearly 50% of their Rome listings recently. In a second-price ad auction, every wasted click drives cost up and ROI down.

At the 2017 VRMA National conference, Steve Milo referred to channel managers as OTA middlemen and coined a new term. Why do property management companies need these OTA middlemen? First, the vast majority of property management firms do not or cannot employ web development talent. Secondly, there is a deficiency of features in nearly every property management software today.

To roll out Google Hotels beyond select big brands, I suspect Google will require using a third-party data solution for smooth integrations and accurate pricing. The channel managers (Integration Partners) will undoubtedly be willing to provide a Google Hotels technology solution, but will keep an additional 2-4% for the service.

Big Brand Preference

As we look at the test markets that are currently live, it is apparent that Google has a desire to work directly with traditional OTAs such as Booking.com and HomeAway instead of small, local property managers. In fact, I could not even find a local company listed in any of the test markets!

Skift estimated that Google Travel generated approximately 14 billion in revenue in 2017 and will continue to grow at 20% annually for the foreseeable future! Where is all of this revenue coming from? Primarily from big brands. Even though Google AdWords has well over one million businesses paying for ads, Expedia and Priceline alone are responsible for over 5% of Google’s total ad revenue. Now, the reason behind the big brand preference is crystal clear and we know it can’t be easily overcome.

Off-Platform Booking Fees Evolve

If you aren’t a fan of the optional HomeAway Off-Platform Booking fee, you will likely hate the GHACP cookie that track users and automatically charges a non-optional commission up to 30 days later.

Once a potential guest clicks on a link that belongs to GHACP, Google cookies the user. If the user were then to come back to your website via pay-per-click, social media, organic rankings, or any other method and converts, the commission belongs to Google.

Small Hilton Hotel Success = Failure for Vacation Rentals?

After Hilton worldwide implemented hotel ads at all 4,200 global properties in early 2011, they saw a 12% increase in ROI compared to traditional PPC ads. Since Google published this case study and regularly mentions it, we can assume this is one of the more successful customers in the program.

Although the Hilton statistic sounds great at surface-level, we must consider whether or not a modest 12% increase in PPC effectiveness makes this a great marketing channel. If your current ads performed an anemic 12% better, would this solve any critical issues for your brand? Would this allow you to be less reliant on the listing sites in a meaningful way?

Also, we must recognize that Hilton was an early adopter (began this campaign in 2011) and benefited from lower competition during this timeframe. The 12% increase in ROI is a lofty target with the increased competition. Finally, if we are wanting to achieve similar results, it is important to honestly assess whether Hilton’s agency/in-house team is similarly skilled at marketing and technology implementations when compared to the average vacation rental management firm.

Closing Thoughts

Although the excitement surrounding Google Hotels can be intoxicating and lead diversification is always great for business, resist the urge to respond emotionally to this new ad channel. Instead, commit to analyze this marketing decision (and all others!) on the basis of data and revisit profitability regularly.

Based on Google’s history and other ad products, we can be confident that the search giant will figure out a way to increase their profits and squeeze more money out of each advertiser. Google doesn’t believe in charity and doesn’t care about the vacation rental niche. On a brighter note, Google’s stock was $50 when AdWords was in its infancy and it closed at $1,035.49 last Friday.

RSS